hotel tax calculator bc

The following table provides the GST and HST provincial rates since July 1 2010. 1 on the first 200000 2 on the portion of the fair market value greater than 200000 and up to and including 2000000.

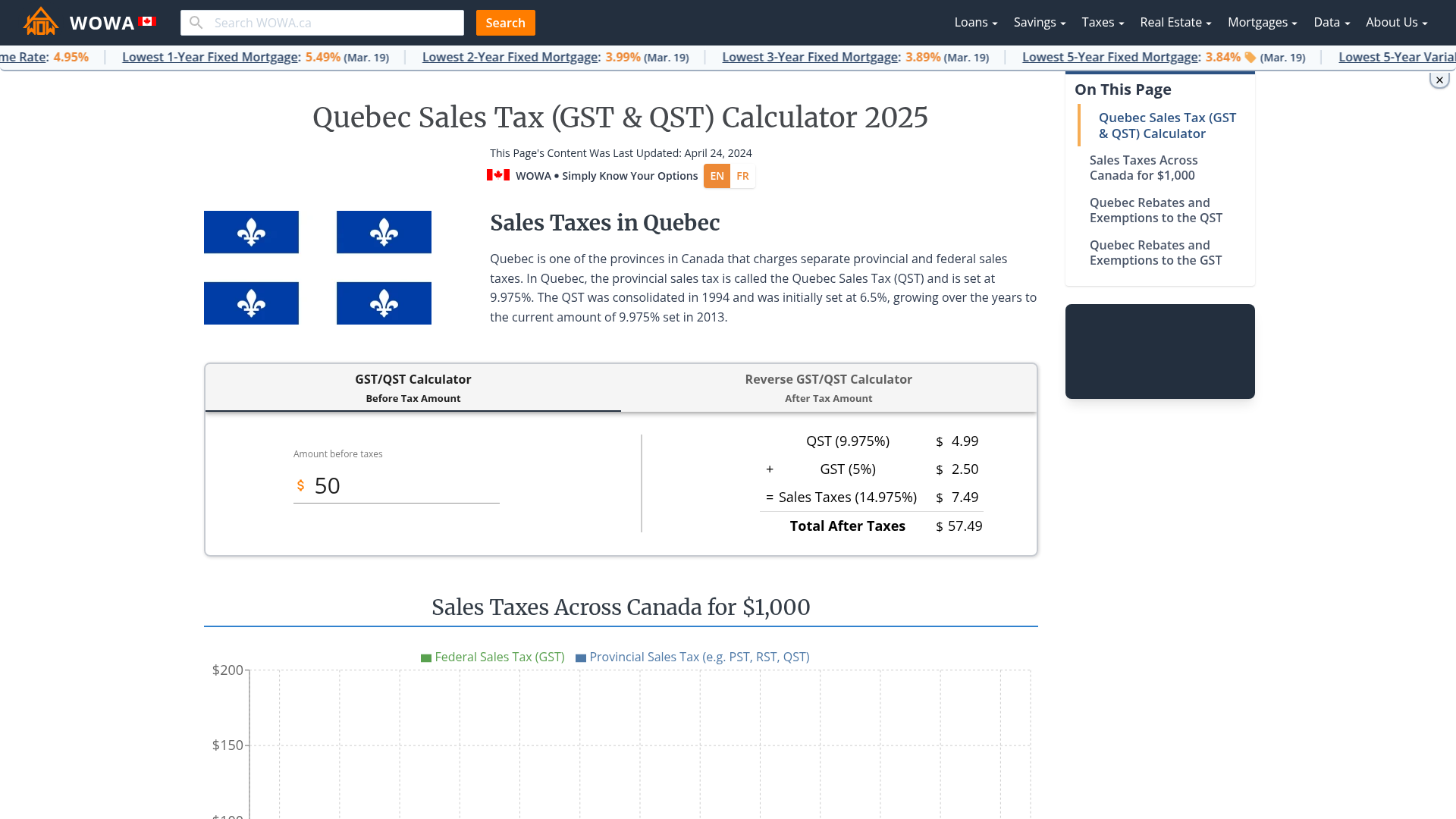

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada.

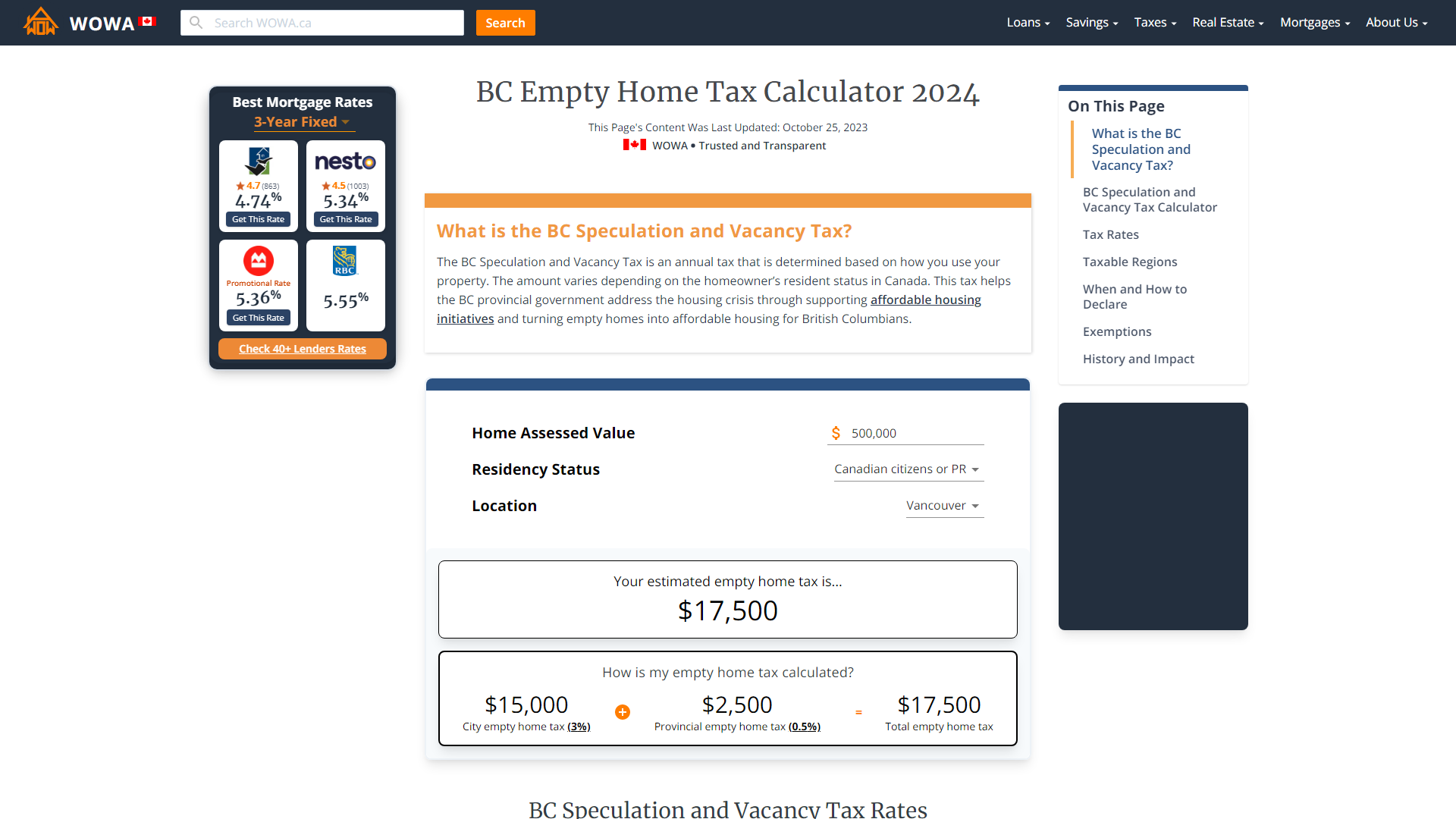

. 3 State levied lodging tax varies. BCs Vacancy Tax can be 05 of your homes assessed value annually. Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all.

Current GST and PST rate for British-Columbia in 2019. GST 5 PST 7 on most goods and services. In 2021 British Columbia provincial government increased all tax brackets and base amount by 1 and tax rates are the same as previous year.

21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. Useful for figuring out sales taxes if you sell products with tax included. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Current GST and PST rate for British-Columbia in 2021. Hotel and accommodation taxes. For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest.

The rate you will charge depends on different factors see. Hotel Room Rates and Taxes. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

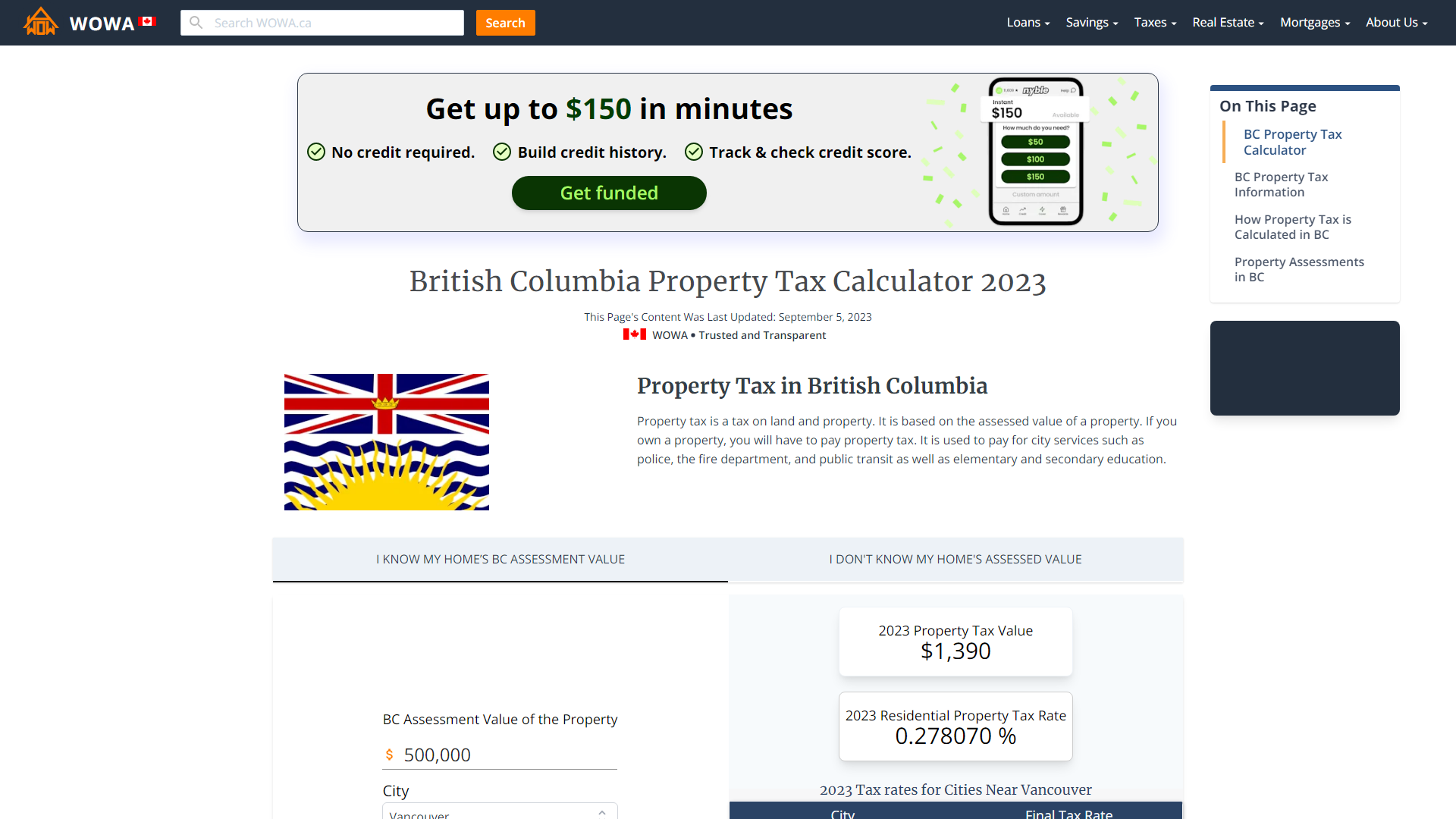

For most residential properties the property transfer tax rate is. For use in BC unless a specific. A tax rate increase will only take effect after an application has been approved by regulation.

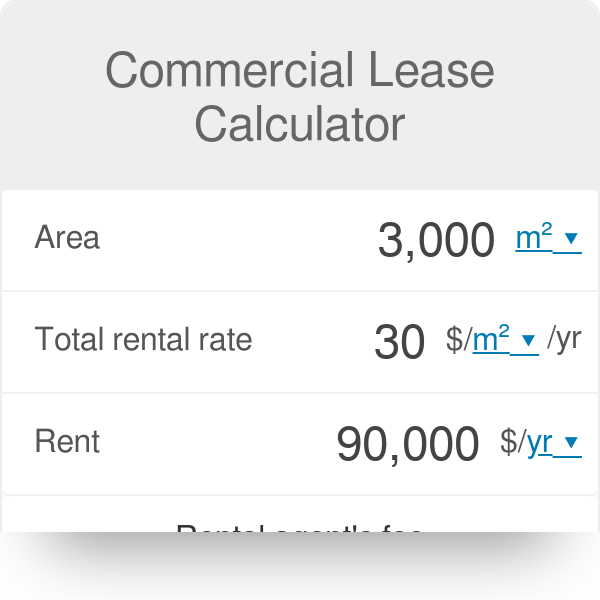

8 rows Income Tax Calculator British Columbia 2021. Sales taxes make up a significant portion of BCs budget. Provincial sales tax PST is a retail sales tax that applies when taxable goods or services are purchased acquired or brought into BC.

Taxable and Exempt Accommodation Definitions For the purpose of PST and. A hotel and accommodation tax or levy is a specific fee on hotel or motel charges. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

Only In Your State. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more.

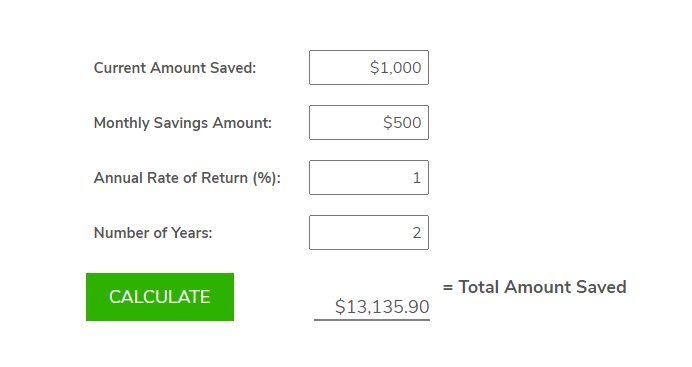

Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. Our GST calculator will calculate the amount of GST included in a gross price as well as the amount you should add to a net price. You can calculate your Annual take home pay based of your Annual gross income and the tax.

Calculate your BC Vacancy Tax from your homes assessed value. Type of supply learn about what. Applies to major cities in BC.

The British Columbia Annual Tax Calculator is updated for the 202021 tax year. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada.

Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. It is generally progressive because it is paid by businesses and higher. No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf.

The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. Base amount is 11070. 1 This regulation may be cited as the Hotel Room Tax Regulation.

Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. BC Revenues from Sales Taxes.

So if the room costs 169 before. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts.

Calculate Import Duties Taxes To Canada Easyship

New Brunswick Sales Tax Hst Calculator 2022 Wowa Ca

British Columbia Empty Home Tax Calculator 2022 Wowa Ca

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Free Simple Savings Calculator Investinganswers

British Columbia Gst Calculator Gstcalculator Ca

Hourly To Salary What Is My Annual Income

Realtymonks One Stop Real Estate Blog Real Estate Marketing Real Estate Easy Loans

We Can Help Anyone Buy A Home Zero Down Or Qualify For A Rent To Own Home We Have Helped Over 13 000 Buy A Rent To Own Homes Rent Rental Property Investment

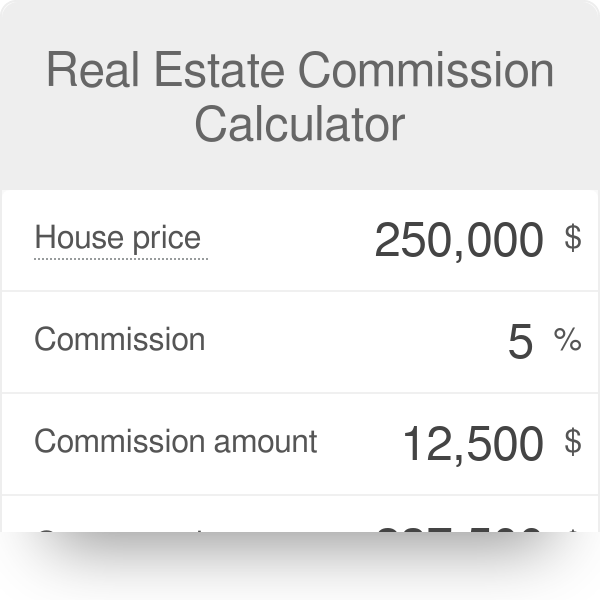

Real Estate Commission Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Mortgage Formula Cheat Sheet Home Loan Math Made Simple Mortgage Loans Mortgage Rates Today Types Of Loans

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Calculating Controlling Your Hotel Operating Costs Qwick

British Columbia Property Tax Rates Calculator Wowa Ca

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor